What Sustainability Capabilities Matter (Part 2) – About DATA

[This was originally published as part of the Future Planet State of Sustainability Study. To request your copy of that report please email eva.]

This is part 2 of the Sustainability Capabilities extract. Part 1 is here.

A quick word about large companies: ESG Reporting is ranked by nearly two out of five companies (38%) as Essential. Interestingly, and probably reflective of their greater financial and compliance reporting obligations, nearly all (89%) of the largest companies view ESG Reporting as Essential or Very Desirable.

A word about data

Before we move on it is worth noting that many companies find the “data issue” a difficult challenge when Measuring Emissions, or indeed measuring any of the other KPIs or metrics that are necessary for their ESG Reporting efforts. It is often a struggle to know what data to collect, what descriptions to use, and how to link the data to various ESG frameworks for reporting. Every data element recorded, whether it is kilowatt hours of electricity, microliters of water, number of part-time employees, or metric tons of waste, will need to include the location, office or site for which it was recorded, the reference time-period, and the related disclosure, (or disclosures) if relevant.

Data about a material topic is needed to understand the current state or usage and the trends over time, to populate ESG reports or comply with other regulations, and to identify risks and opportunities associated with the topic. The detail can be daunting.

If, for example, a company determines that Water is a material topic deserving of attention, it should record data pertaining to (a) Water Withdrawn, (b) Water Discharged and (c) Water Consumed, each broken down by Surface Water, Seawater, Groundwater, etc.

Once the information has been aggregated across all locations and time periods, the company can assess how it might reduce water usage to save money and reduce environmental impact. The structure of data collection should map to how your need to consume or use the data. An “ESG aware” data center will help guide that effort and can inform the connections to the ESG frameworks.

Strategic intent of larger companies

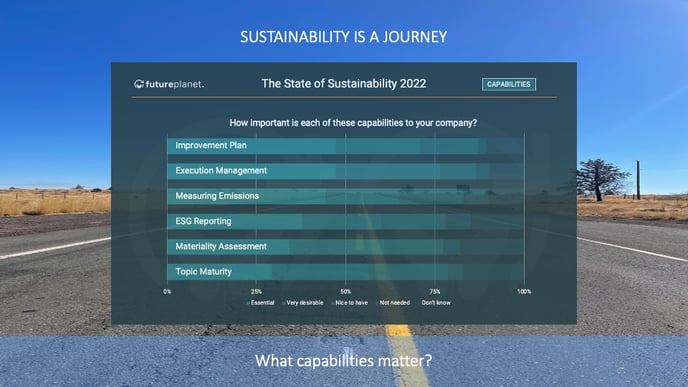

As we span the breadth of materiality topics and sustainability capabilities, there is a clear bias in the larger companies towards the more strategic capabilities. Companies with less than €500m revenue are more tactical, disproportionately looking for improvement plans, but often placing insufficient emphasis on understanding what they should be improving or “what good looks like”.

While it is important for a company to measure its emissions and comply with market and legislative requirements in relation to reporting on ESG, more progress will be made if companies focus on the right topics, and, having selected the right topics, seek to advance their maturity.

There are two legislative frameworks gaining more influence over how companies need to think about scenario and situational analysis as prerequisites for their sustainability strategies.

- TCFD (Taskforce on Climate-Related Financial Disclosures) is a framework that helps companies to disclose climate-related risks and opportunities more effectively through their existing reporting processes. It provides information to investors about what companies are doing to mitigate the risks of climate change, as well as be transparent about the way in which they are governed. TCFD recommendations are structured around four thematic areas that represent core elements of how organizations operate: governance, strategy, risk management, and metrics and targets.

- CSRD (Corporate Sustainability Reporting Directive) is new EU legislation requiring all large companies to publish regular reports on their environmental and social impact activities. It helps investors, consumers, policymakers, and other stakeholders evaluate companies’ non-financial performance. CSRD aims to ensure that companies publicly disclose adequate information about the sustainability risks and opportunities they face, as well as the impacts they have on people and the environment (i.e., principle of double materiality)

There are many other standards and frameworks, but these two, while not wholly representative of the entire ESG landscape, are good reference points for action. Both point to the need for a response to the critical questions that are posed when pressures around climate change, human rights and corporate governance are growing in urgency. Progressive boardrooms must develop strategies to address complex sustainability challenges. The real critical question there is: Where do we begin?

Materiality Assessment was selected as Essential by only one in three (34%) in the study, but it is often the answer to that difficult question.

A Materiality Assessment is a strategic method and toolset to uncover important risks and opportunities relating to economic, environmental, social and governance issues. Strategically applied it can leverage industry benchmark data and ESG reporting frameworks such as GRI, SASB and UNEP, to show how to integrate sustainability into the strategy of the business. (See side panel).

For most companies, a robust Materiality Assessment should be conducted annually following these 5 steps:

- Sector Preview: Leverage sectoral data to benchmark materiality of similar companies in context of SASB, GRI, UNEP.

- Company Context: For each materiality topic consider the Risks and Opportunities for your company.

- Stakeholder Engagement: Engage the opinions of stakeholders affected by, or who could affect the company’s, products or services.

- Materiality Map: Analyse “inside-out” and “outside-in” topics; economic, environmental and social impacts and map accordingly.

- Supporting Notes: Capture the specifics of the process, the stakeholders, impacts and list and evolution of material topics.

[This blog post was originally published as part of the Future Planet State of Sustainability Study. To request your personal copy of the study please email eva.]